Selected quotes from healthcare leaders:

Decentralized HealthTech Advisory

Technology is, slowly but surely, transforming healthcare. HGM Advisory brings together the best HealthTech experts to prepare you for a tech-enabled healthcare future.

A few health systems (especially in the US) start to release the results of their AI & GenAI projects. And the results are very promising.

-

AI scribes reduce burnout: AdventHealth and Mass General report better work-life balance, less paperwork, and more patient time.

-

Next step is billing: systems like St. Luke’s already generate $13K extra revenue per physician.

-

Mayo leads globally: with 97 AI algorithms in use and 270 in development, plus its platform connecting top hospitals.

July 2025

In June 2025, AI scribes made headlines: Nabla just raised a $70M Series C, Tandem Health secured $50M, and Abridge reached a $5 billion valuation in an A16z-led round.

-

AI scribes began as simple LLM wrappers, but new regulations are raising the bar. Many players won’t survive.

-

Smaller firms should target niches, while local champions scale on trust and language; consolidation is coming.

-

Scribes are just the entry point: bigger plays in agentic AI and RCM are already underway, with incumbents bundling scribes for free to defend their turf.

July 2025

Commure, aiming to become the "new operating system of healthcare," has just secured $200 million

-

Fintech showed the playbook: unbundle (Stripe, Klarna, Robinhood), then rebundle into digital-first platforms. Healthcare is now on the same path.

-

Commure is rebundling via acquisitions (Athelas, Rx.Health, Augmedix, Memora) plus in-house workflow tools.

-

Kaiser bets on Innovaccer as the new hospital OS; in Europe, vitagroup and RCM players like Tiplu and Sancare could follow with PE/VC backing.

June 2025

As we enter the post-EHR era, it’s worth understanding who won the first battle: Epic, the leading U.S. EHR founded by Judith Faulkner.

-

Judith Faulkner: the #1 female entrepreneur who built Epic, the world’s leading EHR, from scratch.

-

Kaiser Permanente 2003: Epic won against Cerner after showing it could handle KP’s daily flow with zero downtime.

-

Epic’s edge: a single unified database and integrated billing/clinical system, delivering unmatched reliability and seamless operations.

-

Now in the post-EHR era: open questions remain: integrated vs best-of-breed, the future of hospitals, provider control, Epic’s rigid culture, and whether AI “systems of insights” will overtake EHR “systems of record.”

May 2025

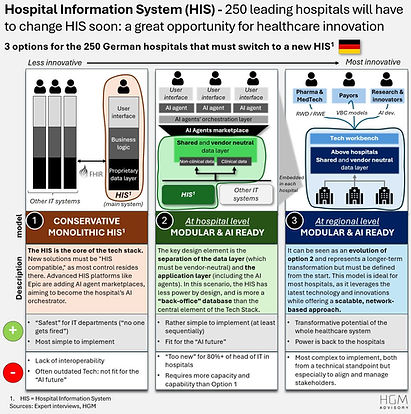

Softway Medical, one of the top 3 Hospital Information System (HIS) in France, has just been acquired by Bain Capital, a US PE.

-

Germany’s chance: 250 leading hospitals (incl. Charité, Helios) could accelerate innovation if even half choose modern solutions over legacy HIS.

-

Shared data layer: the core should be a vendor-neutral data layer, shifting power away from HIS into a post-EHR era.

-

Building blocks: ops platforms (e.g. DNV Imatis) and care pathways (e.g. Careside, UpHill) make the data layer tangible for clinicians.

-

Endgame: regional and system-wide data platforms, like Catalonia’s OpenEHR model, Mayo’s federated platform, Kaiser + Innovaccer, or Truveta, show the path, while Bavaria’s failed portal highlights the risks.

April 2025

The Mayo Clinic (the world’s top hospital) revealed a new cohort of 15 AI HealthTech start-ups for its Mayo Clinic Platform_Accelerate program.

-

Mayo focuses on clinical & preventive AI: most of its 15 start-ups target predictive health, while Google leans more on ops/admin.

-

Japan enters the spotlight: 4 of 15 start-ups are Japanese, signaling a rising HealthTech ecosystem.

-

Women’s health AI expands: niche solutions now, but platforms like Maven will likely rebundle into full-service care.

-

Mayo as blueprint: through Platform_Accelerate and Ventures, it acts as accelerator and VC, reshaping the hospital model.

-

Fast pace: since 2022, 45 start-ups joined its platform and 100+ got venture backing.

April 2025

Apple is planning to launch an AI doctor in 2026 to deliver personalized wellness advice through a revamped Health app.

-

Ranking Big Tech in healthcare: by partnership count since 2023: Nvidia leads, Microsoft second, Google third.

-

Google’s push: from AI in cancer care and genomics (TxGemma) to Pixel Watch 3, Health Connect APIs, Google Wallet health IDs, and 6M AI-powered screenings—Google is scaling fast.

-

Others in play: Oracle is rebuilding Cerner’s hospital system; Meta hasn’t gone deep yet but Llama 4 could matter as open-source gains traction.

-

Bottom line: Despite early hype, Big Tech hasn’t disrupted healthcare. Power remains with incumbents, who lean on scale-ups (e.g. Kaiser + Innovaccer) for more control.

March 2025

DispatchHealth and Medically Home are merging to create the most complete hospital-at-home platform in the U.S.

-

Home care tackles shortages: with a 30% nurse gap ahead, models like DispatchHealth show impact: 1.2M patients treated, 58% fewer ER visits, $1.5B saved.

-

First wave acquired: Signify Health → CVS ($8B), Care.com → IAC ($500M), ClearCare → Wellsky.

-

Diverse models: acute care (DispatchHealth), B2B platforms (Medically Home), companionship (Papa), preventive visits (Signify).

-

Ready for PE: unlike nursing homes, home care enables holistic, end-to-end approaches attractive to investors.

March 2025

Innovaccer, backed by Kaiser Permanente, is launching seven AI agents to help doctors and hospitals fight burnout. Meanwhile, the Mayo Clinic is investing in both RPA leader UIPath.

-

Only top hospitals can adopt AI agents today: 95%+ lack the infrastructure, leaving adoption to leaders like Mayo Clinic and Kaiser, widening the gap with smaller hospitals.

-

Smaller hospitals at risk: with poor working conditions and talent leaving, many will shrink into outpatient centers or close, as seen in Germany.

-

Agents are just the entry point: AI agents will become a commodity; winners will expand deeper into hospital tech stacks. Expect M&A by 2026.

-

Who wins? Big Tech has scale, but many hospitals prefer smaller players for control. Open-source models may be the real advantage.

February 2025

Agentic AI x Healthcare: Hospital CIOs must start building the Agentic AI stack now, as the first companies are already bringing Agentic AI to healthcare.

-

CIOs must act now: AI agents can deliver 10x efficiency, but most hospital IT leaders are stuck maintaining legacy EHRs on tight budgets. Governments should step in with nationwide AI-readiness programs.

-

Interoperability rethink: some argue agents make standards like FHIR obsolete: AI can structure raw data directly if APIs grant access. Rich, contextual data capture remains critical.

-

Bubble or breakthrough? Yes, Agentic AI may be a bubble, but like the internet, not blockchain. Short-term hype may fade, but long-term impact could be massive.

-

Open source first: Models like Mistral show open-source AI can rival closed players. In healthcare, community-tested systems may be the safer bet.

February 2025

A series of recent studies suggest that AI alone outperforms a physician assisted by AI, which is highly counterintuitive.

-

Agreement takes time: AI’s value in radiology is now accepted, but the key is defining when AI outperforms doctors, when humans do better, and where collaboration truly adds value.

-

Investor implications: PE-backed radiology chains must rethink strategies—whether to bet on AI-first, human-first, or hybrid models. A hot topic for the HBI Conference in Paris.

-

Physician training: Weak AI-assisted results may stem from poor training or “automation neglect,” showing education must adapt.

-

Beyond tech and UX: Radiology AI scale-ups must move past algorithms and workflows to redesign operating models and redefine roles.

February 2025

The Stockholm-based health tech startup Neko Health, co-founded by Spotify founder Daniel Ek, has just secured $260 million in a new round of funding, and is now valued at $1.8 billion.

-

D2C clinical is rising: a16z backed Function Health (100+ blood tests by subscription, like Aware in Europe) to predict disease.

-

Beyond the “worried well”: mostly out-of-pocket today, but Germany may reimburse tests, hinting at preventive care adoption.

-

High false positives: at scale, D2C testing risks many false alarms as science lags precision.

-

Science too early: gut microbiome and period blood tests remain unreliable, though future potential exists.

February 2025

As the year 2025 begins, Big Tech, major healthcare companies, leading VCs, and large-scale startups are joining forces to accelerate HealthTech adoption, while legacy player Dedalus is up for sale.

-

Big VCs are partnering with big Tech and big Pharma.

-

Kaiser Permanente is building the post-EHR era.

-

The sale of Dedalus: A new era for hospital IT in Europe?

-

New developments in AI agents in healthcare emerge every week.

January 2025

Hippocratic AI, backed by leading VC General Catalyst, just announced the launch of an AI agent App store for healthcare, while securing a $141M series B at a $1.6B valuation.

-

The silver bullet: Clinicians are in the driver’s seat.

-

AI agent ecosystems might leapfrog many existing solutions on the market.

-

Hospitals stuck in a rigid, monolithic EHR system risk missing the train.

-

In 2025, we’ll see whether AI agents truly have transformative potential or if they’re just hype.

January 2025

Lessons learned from 2024 instead of predictions for 2025.

Top 3 events of 2024 (personal opinion):

-

Hippocratic AI & Tsinghua AI Hospital – AI healthcare agents launched by Hippocratic AI with NVIDIA, while Tsinghua introduced an AI-powered hospital.

-

AI Scribes by Doctolib & Others – Doctolib and others deployed AI scribes to automate medical documentation.

-

CompuGroup Goes Private – Leading European EHR provider CompuGroup transitioned to private ownership

December 2024

Germany is taking the "virtual wards" of the NHS as a role model.

Leading German hospital chain Asklepios has just launched Germany's first “virtual hospital wards”.

-

Remote Patient Monitoring (RPM) required both a rebranding and a comprehensive End-to-End concept.

-

The true benefits of virtual wards are still under discussion.

-

Asklepios' bold move should serve as an inspiration for other German hospitals.

-

This marks the beginning of the unbundling of hospitals, and it’s a positive development.

October 2024

Microsoft has just launched new healthcare AI tools, covering the whole Tech value chain: infrastructure, data layer, AI workbench and AI solutions.

-

Microsoft is the most active of the US Big Tech companies in healthcare.

-

Microsoft Fabric, its unified data store, is particularly promising.

-

Microsoft is betting on Epic.

-

Microsoft is still pushing for closed-source AI.

October 2024

Doctolib just announced the launch of its new AI assistant for doctors, while Huma has just acquired eConsult Health, a UK-based digital triage solution.

-

After the unbundling into point solutions, the rebundling into Digital Health Platforms is happening.

-

More HealthTech M&A is expected in the coming months.

-

Huma: a big bet on e-consult.

-

Doctolib is now looking to play a larger role in shaping the HealthTech ecosystem.

September 2024

Omada Health & Hinge Health have confidentially filed for IPO.

Hinge Health, virtual physical therapy for musculoskeletal, and Omada Health, virtual coaching for diabetes and hypertension), have (confidentially) filed the S-1 to prepare for an IPO.

-

HealthTech IPOs have been a blood bath so far, and DTx have particularly suffered.

-

However there is hope: 20%+ of US HealthTech going public are still unicorns today.

-

The inspiration: Evolent Health?

-

US and Asia have the lion's share of HealthTech IPOs.

September 2024

Pfizer has just launched a new direct-to-consumer virtual service called PfizerForAll, following a similar initiative by Eli Lilly in January.

-

Why is Pfizer launching a D2C platform? Because of macro trends, brand equity, patient access, and bargaining power.

-

The success of Hims & Hers must have inspired Pfizer.

-

Pfizer is willing to build an ecosystem around its indications.

-

A US approach, not really applicable in Europe.